Fintech is a booming sector of the digital economy.

According to a recent report by Goldman Sachs, fintech companies around the world have claimed over $4.7 trillion in revenue from traditional financial services firms. And that number continues to grow every year.

There are many reasons for this. But one of the most important is the superior user experience (UX) fintech offers.

Often, financial products are complex, and can be challenging for consumers to fully understand. Plus, many traditional financial organizations are mired in red tape and lack transparency — which makes the customer journey even more frustrating.

Successful fintech startups differentiate themselves by focusing on UX and customer satisfaction. This customer-centric approach helps them win significant market share from incumbents.

And this is exactly why AMP for Email is such an exciting technology for the sector. (AMP stands for “Accelerated Mobile Pages”.)

With interactive AMP email, fintech companies can improve the financial customer journey even more. After all, AMP technology builds on their natural strengths by offering a frictionless experience to subscribers.

So in this article, we’ll explore five types of AMP email campaigns fintech companies can implement to boost their marketing strategy.

Account Opening & Onboarding Emails

As we’ve seen, financial products can be intimidating to consumers. Typically, there are a lot of numbers and jargon words to decipher! So it’s crucial for the onboarding process to be as easy as possible.

This is true for both fintechs and traditional financial institutions. According to the Bank Administration Institute, banks that offer a digital account opening process have experienced 16% year over year revenue growth. On the other hand, banks that depend on physical branches have seen a 9% decrease.

And this is even true of business banking. Six of the top 30 US business banks offer digital account openings, and they hold 30% of all US small business deposits.

But offering a digital application is just the first step. If the onboarding process is too long or complex, customers will walk away and try another provider. In fact, digital identity services provider Signicat found customers abandoned 40% of digital applications in 2016. And by 2020, the abandonment rate increased to 63%. So fintechs that offer a streamlined onboarding flow have a major advantage.

The Benefits of AMP for Email

To see how AMP can help, check out this onboarding email from GoBank:

Overall, this is a good onboarding email. It lays out three clear steps for customers to start using their account. It explains each step briefly without overloading the customer with detail, and includes a phone number and email link for customer support below.

The main shortcoming of this email? It’s a static message with no interactive email functionality. That is, the customer has to click on separate links to perform each step in the process. AMP can make this email experience much simpler.

For step one, the current email requires the user to click through to the bank app. Then, they select the deposit method. This second click takes them to the depositing institution’s website to complete the transfer of funds. That’s a lot of clicks!

With an AMP email template, you could select the depositing institution right in the email itself. You could also send the customer straight to their current bank, Paypal, or other digital account to complete the transfer.

For step two, the customer might have to print out a direct deposit form and submit it to their payroll office. An AMP email could simplify this process by providing an interactive form in the email itself. The customer could complete this form and automatically send the information to their employer.

Finally, a link to customer service is certainly useful. But wouldn’t it be even more useful if you could interact with customer service directly? With AMP, you could include a live chat box, so customers could speak to a support rep without ever leaving their inbox.

The common theme here is to:

- Minimize the number of clicks;

- And minimize the number of pages the customer has to visit to complete the onboarding process.

As a rule of thumb, less clicks equals more conversions. In other words, by providing a frictionless, dynamic email experience, AMP can help increase completion rates. Not to mention, make a great first impression on customers!

Education Emails

In the world of fintech, customer education is key.

Why? Because of the complexity of the service. And because these services require more of a financial and emotional commitment than most consumer products.

On top of that, fintechs tend to offer a range of complementary financial products. As a result, the customer needs to understand multiple offerings, and how they’re related to each other.

So it’s especially important for fintech companies to take a clear, structured approach to customer education.

The Benefits of AMP for Email

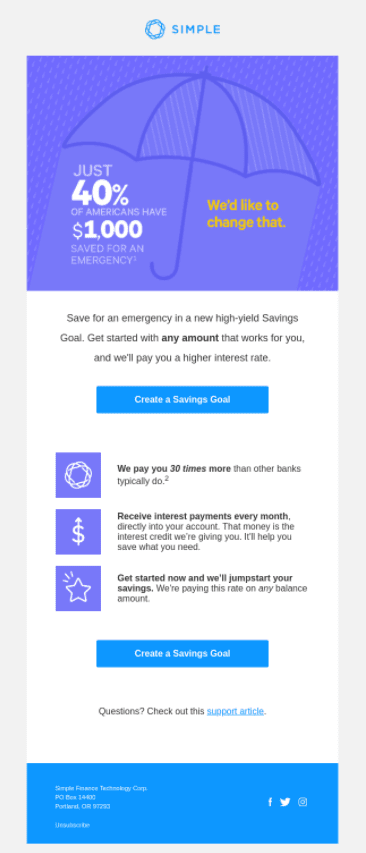

The best type of education email combines useful information with a clear call to action. For example, check out this email from Simple:

This email was sent to existing customers in the low-income bracket — a segment that could benefit from a high-yield savings account. Since these customers were unlikely to be familiar with the product, the email campaign included an educational component explaining the account’s benefits.

Rather than start with the product itself, Simple opted to focus on saving for emergencies. A smart approach as this message would likely resonate with the customer segment.

Then, the high-yield account is introduced as a tool to reach this goal. The message is consistent throughout. Even the call to action focuses on creating a savings goal, not opening a new account.

AMP can improve this email campaign even further.

For example, instead of clicking through to Simple’s app to create their savings goal, the customer could do so in the email itself. And this type of interactivity is a proven way to increases engagement.

The email could even include personalized suggestions for which portions of their monthly budget customers might want to tap for their savings plan.

Then, instead of explaining Simple’s high-yield account can pay 30 times what another bank would, the email could include a calculator. This interactive email calculator would show how much faster customers can get to their savings goal with Simple’s account.

Instead of an abstract statistic, customers could see exactly how many days it would take to reach their personalized goal — a much more concrete way and personalized way of understanding Simple’s benefits.

By following the age-old principle of “show, don’t tell”, fintechs can make it much easier for customers to appreciate their offerings. And ultimately, maximize customer lifetime value.

Notification Emails

Financial products are highly regulated. What does this mean for the user experience?

For one, companies are often required to notify customers about legal updates, product changes, and upcoming application or filing deadlines. These emails can also include a security component. For instance, emails sent for two-factor authentication (2FA) purposes, or informing customers about recent log-ins to their account.

Apart from regulatory requirements, many fintech products focus on tracking timely financial information such as credit scores and stock portfolios. The value of such products is directly tied to how regularly users monitor their data.

In both these cases, notification emails play a critical role in the customer experience.

The Benefits of AMP for Email

Here’s an example of a security-related notification email from Revolut:

This email notifies the user that a previously requested secure document is now available. And it requires a 2FA passcode from the user’s cell phone before download. The current flow requires the user to click through to the website, enter their phone number, then input the passcode on Revolut’s site.

With AMP, the user could complete this entire process in the email itself. Note, this will require the user to have provided their phone number previously on Revolut’s site, as email forms may not be sufficiently secure to provide 2FA or other sensitive personal details.

But assuming that’s the case, the user could simply click a button in the email to get a passcode on their phone. Then, input it and get a link to download the documents. Since the passcode itself is temporary, it doesn’t pose the same security risk as providing the user’s permanent phone number.

Credit Karma provides an excellent example of a tracking-related notification email:

This email incentivizes the user to click on the link to check their credit score on Credit Karma’s secure site. AMP can improve the experience by allowing the email to update in real-time. The position of the arrow on the graphic could change depending on the difference in credit score since the user’s last log-in.

As with the previous example, companies should still be careful to observe data regulations. For example, AMP could technically be used to show the user’s real-time credit score, along with the latest transactions that affected the score. But since email isn’t a secure medium, sharing such sensitive data via AMP would be unwise.

Still, when used judiciously, interactive AMP emails can greatly improve the notification experience — without compromising on data security or regulatory compliance.

Product Announcement Emails

The financial landscape is rapidly evolving. So the most successful fintech firms are able to respond to customer needs by developing new financial products over time.

Announcing new products to your existing customer list is one of the most reliable ways to get fast traction. Since those customers already trust you, they’re more likely to sign up for a new product. That is, as long as they understand how it benefits them!

An effective product announcement email needs to answer four questions:

- What is the product?

- How does it work?

- What benefits does it provide?

- What do customers need to qualify for the product?

And similarly to new account applications, the signup process needs to be clear, efficient, and hassle-free.

The Benefits of AMP for Email

Consider this email from Aspiration:

This email answers the first three questions succinctly. It starts with a quick introduction to the product. It explains exactly how the product works and its unique benefit — 10 cents of every dollar donated to charity.

The email is also makes it clear that the application must be made within seven days to qualify. And it explains the invitation can be passed on to the customer’s friends and family.

The only open question is whether the user qualifies for the product. This is especially relevant given the transferability of the invitation. Often, this is hard to address in the email itself, as there can be a number of requirements.

But with AMP, the email could include a simple questionnaire that allows customers to check if they’re eligible. That is, without having to go through the full application process. The questionnaire would ask for general information — such as broad income ranges instead of specific dollar figures — both for the comfort of new customers as well as to minimize security risks.

The questionnaire could also ask if the applicant is an existing or new customer. And this, combined with the other information provided, could be used to filter applicants into different application streams on Aspiration’s site.

By streamlining and personalizing the application process, these upgrades could significantly improve conversion rates for both existing and new customers.

Referral Emails

Fintech products are sophisticated and include a significant service component.

This means, new customer acquisition requires a high degree of trust. By far the best way to quickly earn that trust is to be referred by an existing customer.

Ironically, these attributes make it hard for customers to explain fintech products to their friends. If fintech companies want to earn more referrals, they have to find ways to do most of the education themselves.

The Benefits of AMP for Email

Referrals can be challenging with static emails. Take this email from Revolut:

The email does a good job of explaining how the referral works. And why the customer should make the referral (a 10€ bonus for them and the referee). It also gives customers the option of sending an email via their dashboard, or copying a referral link directly to their friends.

Once the referee clicks on the link, they’re sent to a customized landing page. This landing page includes the referrer’s name and a concise description of Revolut’s benefits:

While this process checks all the boxes, the sequencing of information isn’t ideal. The referee has to click on the link before they can see an explanation of why they should be interested in Revolut in the first place! So if the referrer had sent the link themselves, the referee is unlikely to have much context.

With AMP, the referral email itself could include a form that allows the referrer to send out an automated email from Revolut — without having to log in to the website. This allows Revolut to control the messaging in the referral email. And perhaps even customize it by including the referrer’s name in the subject line, thus increasing open rates.

It’s also easier than requiring the referrer to compose a new email blast and copy over the link. Or log in to their dashboard just to send the referral. And when marketers make things easier for customers, conversion rates improve.

So AMP for Email can improve success rates at every stage of the referral process, from sending to opening to ultimate conversion.

Get an edge on the competition with AMP for Email

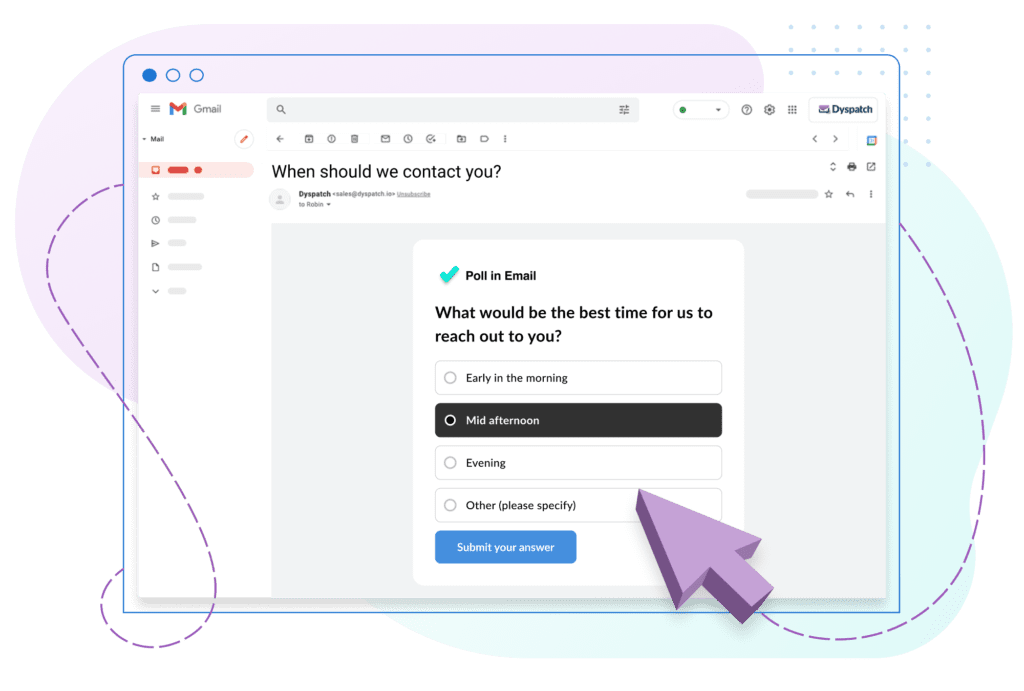

AMP emails can provide fintech companies with a powerful advantage over financial incumbents and other fintech competitors. The easiest way to get started is with Dyspatch’s user-friendly, no-code AMP email builder.